We’ve all heard the advice that we should keep our business and personal finances separate. This has always been good advice. Depending on the type of business entity you started, it may not have actually been necessary, but it was still a good idea.

There are some very good reasons for this separation. One of the reasons for writing this article is to help protect you from the IRS. So we will talk about that first. Then we’ll talk about some other reasons that may or may not apply to you.

First let me tell you a little bit about IRS audits. Most of them are not the all-encompassing horror stories you hear about. Most are done by mail or in the IRS’s office and focus on a specific area. For example, the IRS may ask you to verify your mileage for the year by showing them your mileage log. Or they may ask you to prove another area by showing them your accounting records.

This request for accounting records is what this article is all about. In the old days, when records were kept on paper, it was easy to just show the IRS the particular expense category they were interested in. You could bring in worksheets backed up by the specific receipts for each expense.

In this day of computers though, it has become both easier and more difficult at the same time. It’s easier in that the actual act of accounting is easier and much less time consuming. It’s more difficult though, in that it can be very challenging to just show the IRS what they want and nothing else.

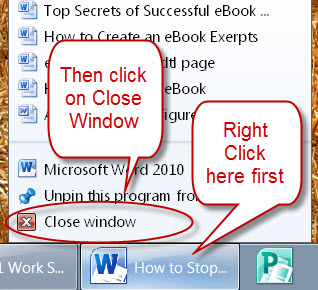

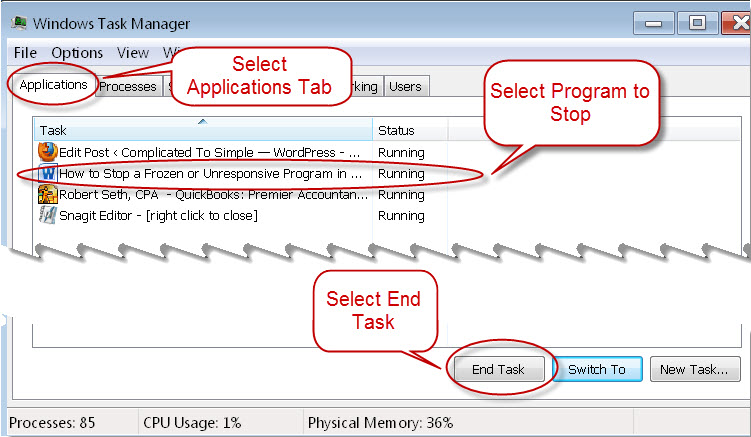

According to recent regulations, it is allowable for an IRS agent to request you actual QuickBooks file. Agents are being officially trained in the use of QuickBooks so they know how to work with these files they get from taxpayers.

If the problem with this is not obvious to you, let me explain why you should be concerned. By giving them access to your whole accounting data file, they can see everything! Now, instead of just seeing the area of interest, they can see everything you spent on anything.

An agent, when getting a file like this, is supposed to only look at the area in question. The IRS has even been publishing guidelines for agents to make sure they don’t look any further. However, they are only human, just like you and I, and you know what they say about curiosity.

It’s bad enough that all your records are there for them to see if they choose to deviate from their rules. What can be even more of a problem though is if your personal records are there for them to see too.

Please don’t get me wrong here. I never advocate cheating on your taxes. I fire clients immediately if I suspect they are falsifying any of their records. The problem is, if they can see your personal records too, it can cause the audit to become much longer and more costly.

Unfortunately, the IRS, under the current administration, is not the friendlier version we’ve gotten used to seeing in recent years. They have declared war both on taxpayers and preparers. They seem to think that everyone is trying to cheat. Many agents assume guilt until proven innocent instead of the other way around.

So you don’t want to give them any more information than they require. It can lead to seemingly innocent questions that are designed to confuse and illicit more information. Sometimes it can be difficult to answer these leading questions without incriminating yourself. This holds true even if you have nothing to hide. This process only leads to more questions and lots of stress. If you are being represented by someone, this can also lead to many more hours of time that you’ll be billed for.

To avoid this problem, it is best to just leave your personal finances out of the picture altogether. Always have a separate checking account for your business. Don’t write checks for personal expenses out of your business account. Instead write a check for a withdrawal and deposit that to your personal account. This advice goes for electronic transactions too.

In this way, under most circumstances, your personal life will be well out of the view of the IRS or any state auditors as well. Depending on the type of audit you have, you may still have to produce personal records. However, this is unusual in most audits.

There are some other reasons this separation is a good idea. You will save yourself so much money on tax preparation if you keep your personal stuff out of the picture.

When personal expenses are included in business records, some almost always end up under the business categories instead of in draws or distributions where they belong. Conversely, sometimes business expenses end up in draws. This is due to lack of accounting knowledge or may just be an honest mistake. Either way, it will be easier to correct your records if personal expense are not there to begin with.

Your tax preparer, because he or she is practicing due diligence, will look at everything in your accounting file. This is because there are almost always misclassified items, whether in your favor or not. Your preparer wants you to pay the least legal tax possible while also protecting you from doing things wrong.

If your accounting file is twice as big because of personal expenses, that’s a lot of extra stuff to look at. I have prepared returns that have cost clients hundreds or even thousands extra because I had to wade through accounts that contain so much personal stuff. This is really a sad and unnecessary waste of money that is so easy to avoid.

The other thing to consider is how much of your personal life do you want to make public. Again, we are all human and it’s hard to forget something once we’ve seen it.

I once had a client that bought all kinds of lingerie and other paraphernalia for his wife through his business account. At least, I hope it was for his wife! I won’t go into any details here, but I will say that it was kind of embarrassing. This kind of thing does not belong on public display, so it should be left in your personal records.

In summary, while it is legally permissible in some circumstance to pay personal expenses from business, it is not recommended. You will have much better protection as well as pay much lower professional fees if you just keep personal expense to your personal account.

If you enjoyed this article or have something to add, please feel free to comment. I always enjoy hearing from my readers. Also, please click the like button in the Facebook box in the left margin. Thanks for visiting!

About Robert Seth

Robert  Seth is a CPA in the Clark County, Washington area who has been serving individual and small business clients for the last 25 years. His business includes a growing number of remotely serviced customers throughout the United States. He’s also a writer and technology expert. He has a passion for improving the lives of others by helping them simplify the complicated stuff in their lives.

Seth is a CPA in the Clark County, Washington area who has been serving individual and small business clients for the last 25 years. His business includes a growing number of remotely serviced customers throughout the United States. He’s also a writer and technology expert. He has a passion for improving the lives of others by helping them simplify the complicated stuff in their lives.